‘Stay and Spend Scheme’: Consumers who invest certain amount in the hospitality sector eligible for tax credits

Although the epidemic has hit many areas hard, the hospitality industry has been worst affected, Taoiseach Michelle Martin said. He said public health measures had to be imposed on the hospitality sector to prevent the spread of the virus.

Finance Minister Paschal Donohue said the hospitality sector is very important to the Irish economy and accounts for about 10% of the workforce in the country.

In view of all these, Taoiseach Michael Martin, Finance Minister Pascal Donohoe, Media, Tourism, Arts, Culture, Sports and Gaeltacht Minister Catherine Martin have come up with a new scheme called the ‘Stay and Spend Scheme’.

Consumers who spend a certain amount in the hospitality sector are eligible for tax credits.

The scheme will run from October 1 to April 30 and will help boost sales in the hospitality sector, Taoiseach said.

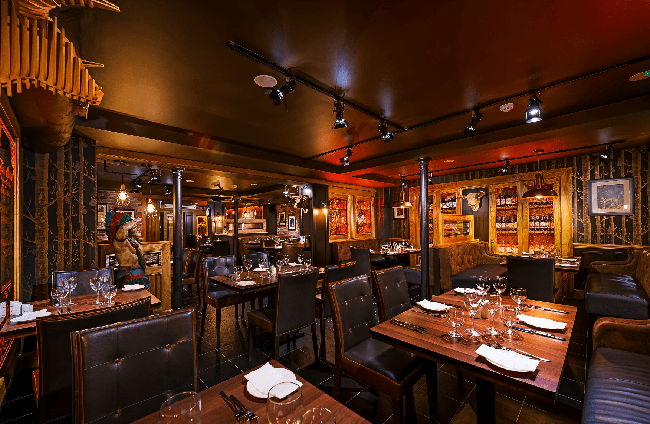

The plan would offer a maximum of €125 in income tax credits to taxpayers who spend up to €625 on restaurants, pubs, hotels, B&BS and other eligible businesses from the fall of 2020 to the spring of 2021, including the Christmas time frame.

Donohoe said the tax credit would be of great help to the hospitality sector during the autumn and winter months and would encourage people to camping and eating out.

Meanwhile, Martin said that we recognize the pressure of people in the hospitality sector and have taken the necessary steps to help them during this difficult time.

To show the solidarity with the scheme, Fáilte Ireland announced that it would launch a national media campaign in the coming weeks.

The scheme will come into effect from the beginning of next month, but residents and food businesses can now register with Revenue to participate.

Comments are closed.